Industry Requests Consideration on: –

- Sector Specific Stimulus Package Including Complete Waiver of Interest on Loans

- Extension On Moratorium of 3 Years on the Principal Amount For All Loans

- Direct Benefit Transfer of Basic Pay to Employees

- Expediting Payments Due Towards The Sector Under SEIS & IT refund

- Waiver of Secondary Condition on Avg. Foreign Exchange Earnings Under EPCG Scheme & Treating Payment From Foreign Tourists In INR As Forex Earning

- Bringing The Tenor of ECLGS 1.0 & 2.0 at Par With The Tenor Of ECLGS 3.0 And Provisioning of Additional Funds Under The Same Scheme

- Removal Of Rs.50 Cr Cap Under The Special Restructuring Window & Of The Condition Requiring Accounts Classified As Standard As Of March 31, 2021

Senior delegates from India’s apex Hospitality Association, the Federation of Hotel & Restaurant Associations of India (FHRAI), met with Hon’ble Tourism Minister Shri Prahlad Singh Patel and Hon’ble MSME Minister Shri Nitin Gadkari yesterday to discuss the deteriorating state of the Hospitality and Tourism industry and to recommend immediate fiscal measures to save it from impending collapse.

The Association made submissions proposing critical policy improvements for the sector’s rebirth. Mr Gurbaxish Singh Kohli, Mr Pradeep Shetty, Mr D V S Somaraju, and Mr Narendra Somany represented the FHRAI. The delegates informed the Ministers of the industry’s dire position as a result of the two lockdowns.

The Association’s representatives also met with Mr Arvind Singh, Secretary, Ministry of Tourism, and Mr Rakesh Kumar Verma, Jt. Secretary, Ministry of Tourism, and presented their case to them. The Association recently held a virtual discussion with Mr Sanjeev Sanyal, the Principal Economic Advisor for the Ministry of Finance, to discuss ideas particular to the hospitality industry.

The Tourism Ministry acknowledged the sector’s worries and promised that the appropriate assistance would be provided to assist the industry. It has also stated that the Prime Minister and the Finance Ministry will be informed of the sector’s concerns and proposals made by the FHRAI delegates.

The Tourism Ministry is constantly monitoring the SEIS plan with the Ministry of Finance, and other problems will be addressed individually with the respective Ministries.

The MSME Minister has also stated that they are aware of the difficulties the business is facing and that they will consider the industry’s concerns over the ECLGS scheme and the RBI’s Resolution Framework favorably. Mr. Sanyal has also stated that the industry’s demands will be considered favorably and as soon as possible.

The Association has thanked Shri Prahlad Patel ji, Shri Nitin Gadkari ji, Mr Sanyal, Mr Singh, Mr Verma for their valuable time and for understanding the industry’s concerns.

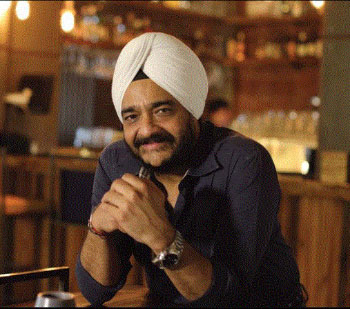

Vice President, FHRAI.

“The pandemic has devastated the hospitality sector, businesses are steadily closing and NPAs are rising. In our meeting with the Ministers, we recommended a well-made sector-specific stimulus package that addresses the most critical aspects of reducing financial loss, mobilizing loans, and retaining employment.

The recommendations include complete waiver of interest on loans beginning March 2020 till business normalcy resumes, the announcement of special measures for the industry and the interest burden of loans borne by the Government for a fixed period, monthly basic salaries paid directly to tourism, travel and hospitality employees who have lost their jobs due to the pandemic, provision of a moratorium of 3 years on the principal loan amount, working capital support at interest on fixed deposit rate plus 2 per cent or MCLR rate, the urgent release of SEIS pending payments, removal of secondary condition in EPCG and introduction of a long term financing scheme for at least 10 years back with a guarantee from Central Government to Banks and NBFCs,”

says Mr Gurbaxish Singh Kohli, Vice President, FHRAI.

The industry’s overall revenue in FY 2019-20 was Rs.1.82 lakh Cr, and according to our projections, about 75% of the industry’s revenues will be wiped off in FY 2020-21. The Indian economy will lose more than Rs.1.30 lakh crore in revenue. Today, the hospitality business has a total loan due of approximately Rs.60,000 crore.

Jt. Hon. Secretary, FHRAI.

“Since April 2021 the revenue hasn’t even crossed 8-10 per cent. Our right to conduct business was taken away, but our lenders’ right to recover loans and charge interest is being allowed. The Hospitality industry is under tremendous cash flow pressure to meet its operating expenses including payment of salaries and wages, repayment obligation to banks and financial institutions, and funding its capital expenditure plans.

We request timely payment of cash flows under the SEIS scheme and refund of income tax payment that is due to the Hospitality sector. This will make a big difference to the ability of hotels to pay the workforce employed in the sector, meet the operational expenses and manage loan repayment obligations,”

says Mr Pradeep Shetty, Jt. Hon. Secretary, FHRAI.

Under the EPCG program, the Association has proposed a waiver or relaxation. In terms of average Foreign Exchange Earnings (FEE), the industry has indicated that there is no FEE to redeem the license because there has been no foreign travel during the pandemic.

Even before the pandemic, foreign visitor arrivals and expenditure were low, and the EPCG standards were hard to meet. As a result, the requirement should be totally canceled, and the conditions should be regarded met and completed.

It has also been proposed that international tourists visiting India and staying and spending in hotels be considered foreign exchange earned by hotels for the purposes of EPCG license redemption.

During the epidemic, the Association has also demanded that Bank Guarantees and corresponding FDRs and IGST be released, as well as waivers or reliefs for Greenfield Hotel Projects and development of existing hotels.

Since the first shutdown, 40% of hotels and restaurants in the country have closed permanently due to financial losses, and about 20% haven’t reopened fully. The remaining 40% is continuing to lose money. The industry has been placed on a bad list by financial institutions.

Hon. Treasurer, FHRAI.

“The industry is grappling with indescribable financial issues. It is imperative to make some additional provision of funds under the ECLGS and align the tenure and moratorium facilities of ECLGS 1.0 and 2.0 in line with ECLGS 3.0 to support the survival efforts of the sector. We have requested provisioning a special window for restructuring for the sector without any cap on loan exposure.

We have also asked to set up a redressal forum by the Government or the RBI to address issues faced by the Hospitality industry in availing loans for restructuring. Being the worst hit amongst other industries, the Association has suggested several steps in aiding the revival of the sector which will be crucial in the long-term health of both the sector and the country’s economy,”

concludes Mr D V S Somaraju, Hon. Treasurer, FHRAI.

Read more at TravelMail | Follow us at Facebook | Twitter | Instagram for on the go news